We have a differentiated investment strategy,

leveraged in our industrial profile, expert knowledge of the region, asset value optimization and ARF’s ESG+ approach to identify and mitigate risks.

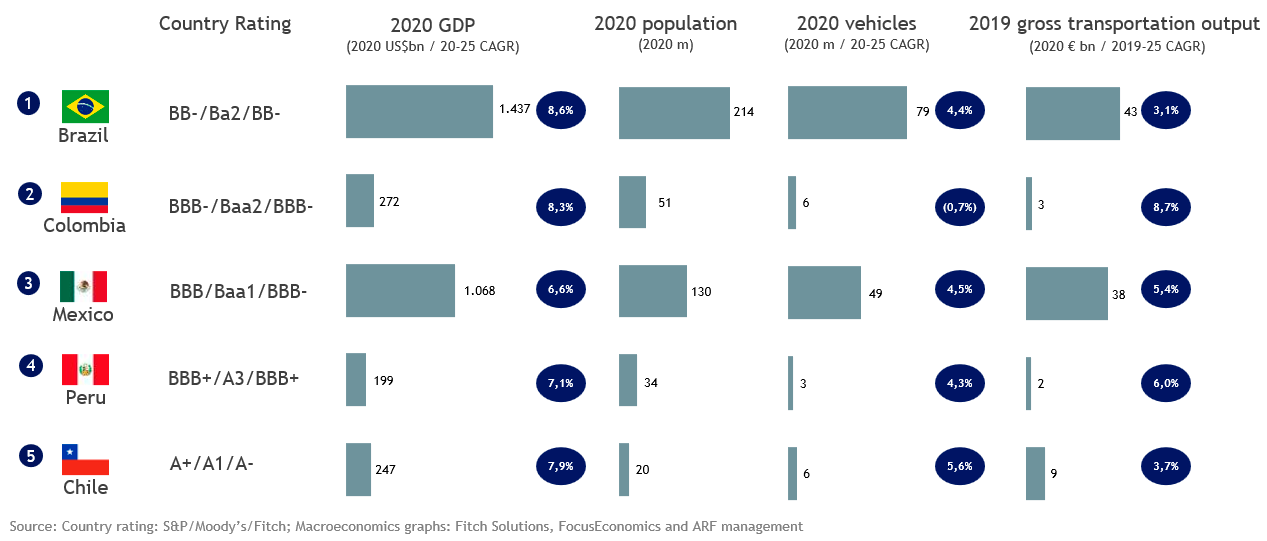

Geographic focus

Brazil, Peru, Mexico, Colombia and Chile.

Asset focus

Majority stakes in highway brownfield projects in the secondary market with the following characteristics:

- Low demand risk

- Construction risk limited to expansion plans

- Protection from exchange rate fluctuations through local currency financing and equity protection mechanisms agreed with the investors

Under current economic environment, ARF can provide quick execution to toll road concession holders that want to recycle capital

Size

Up to US$ 500 MM investments

Period

Average target investment period of 7-10 years

Roads are an attractive investment opportunity…

… and Americas Road Fund is the right partner to invest in them

We have an experienced team in long term road concessions, having participated in consortia with local partners or other investment funds.

We are focusing on attractive markets with safe legal regimes, high growth potential, controlled inflation rates and adjusted interest rates.

We have ample knowledge of these targeted markets, the conceding organisms, potential partners and possible collaborators for the development of these contracts.

We have a head start over other international players in the region who are still learning the particularities of these markets.

Our management is aligned with the highest standards of corporate governance and offers full transparency and long term alignment with society and the environment.